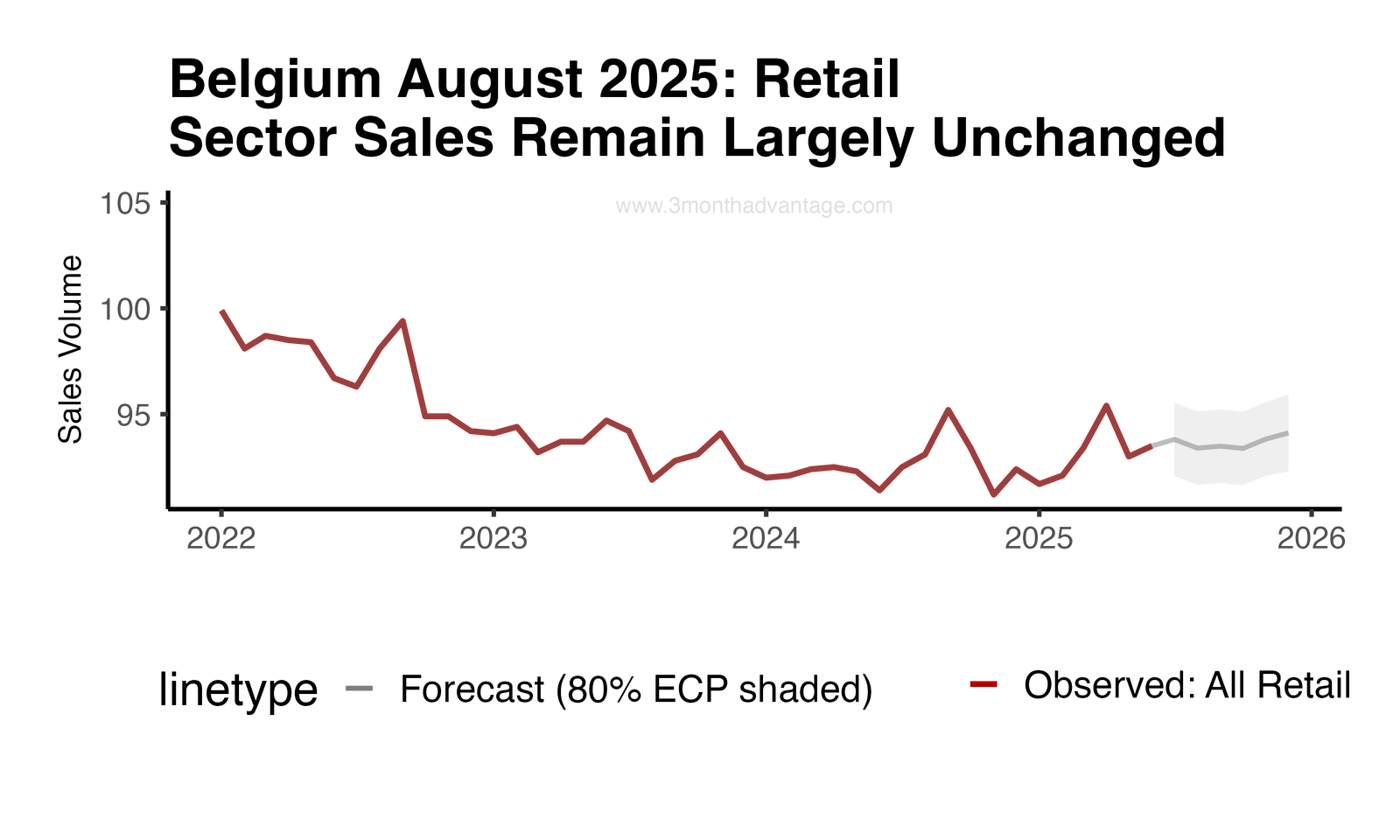

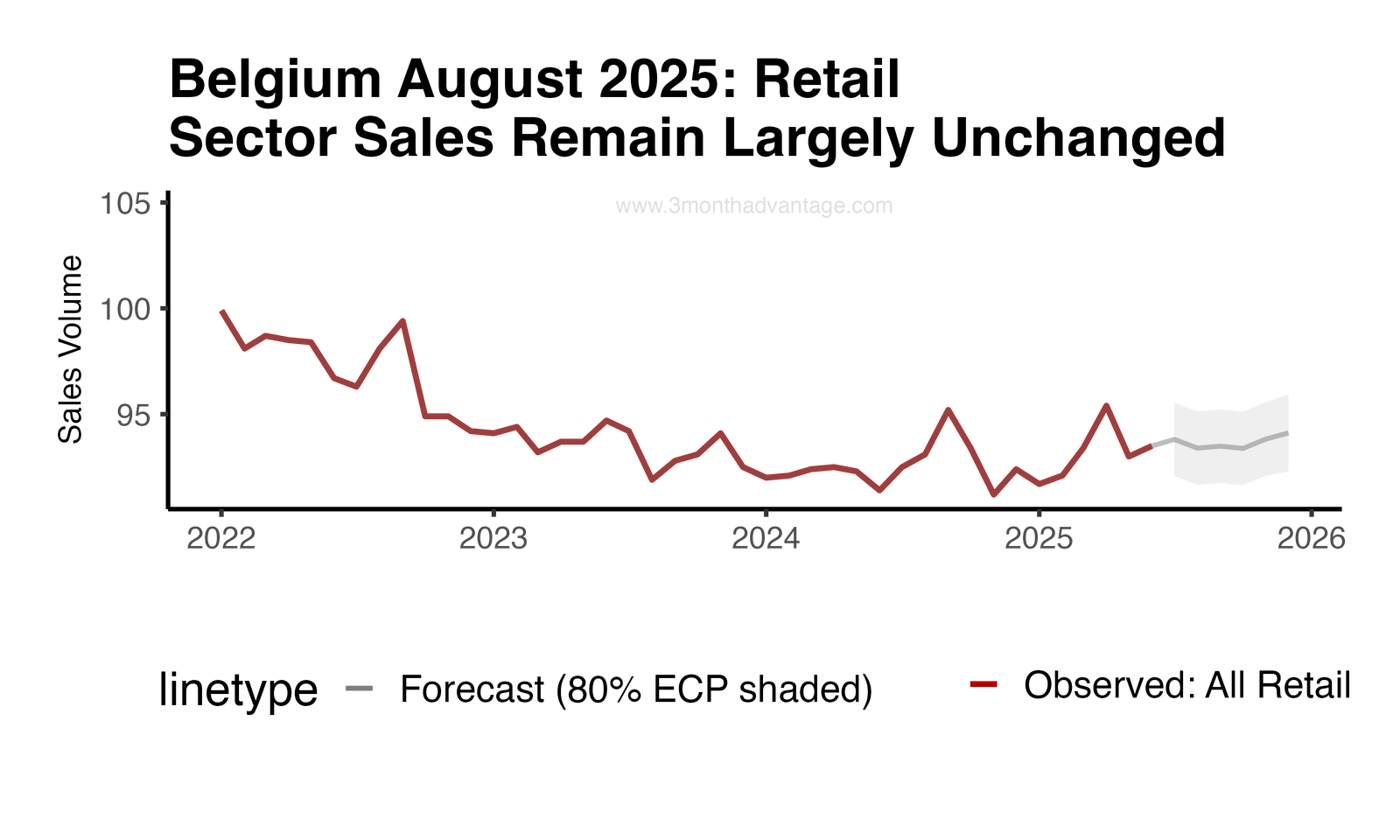

The retail sector in Belgium is expected to see a slight contraction of 0.1% in August. Current month-on-month momentum shows a decrease of 0.4%. However, a recovery is anticipated by December, with sales expected to rise by 0.7%. The sector's three-month forecast volatility is 0.2, reflecting a reduction of 0.65 from the previous year. These projections are based on Eurostat's consumer retail index data.

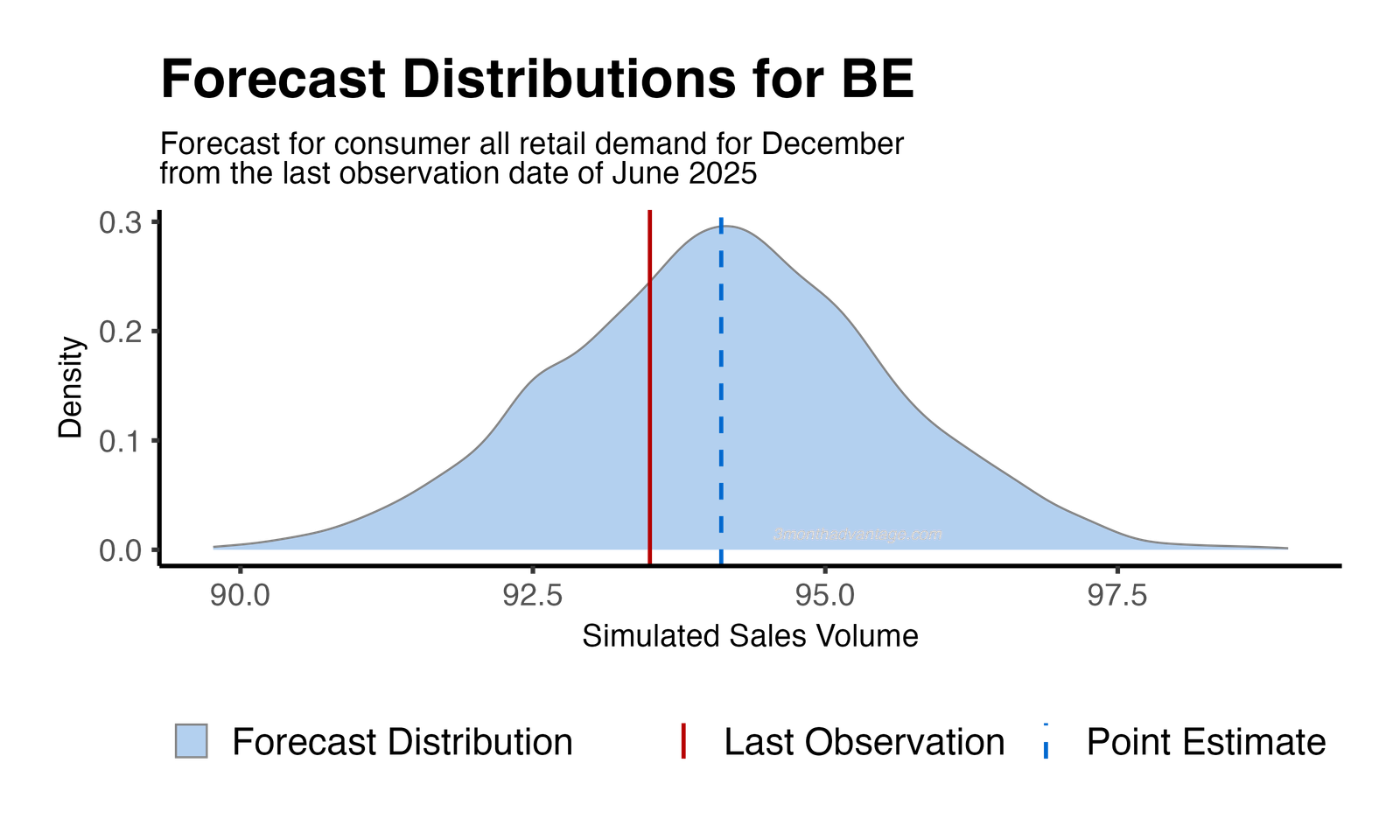

The forecast for the retail sector from June 2025 to December 2025 indicates a 66% probability of increased demand. The distribution curve illustrates forecast uncertainty, with the peak representing the most likely demand levels and the tails indicating less probable outcomes. This suggests a strong likelihood of growth, but with some variability in potential demand scenarios.

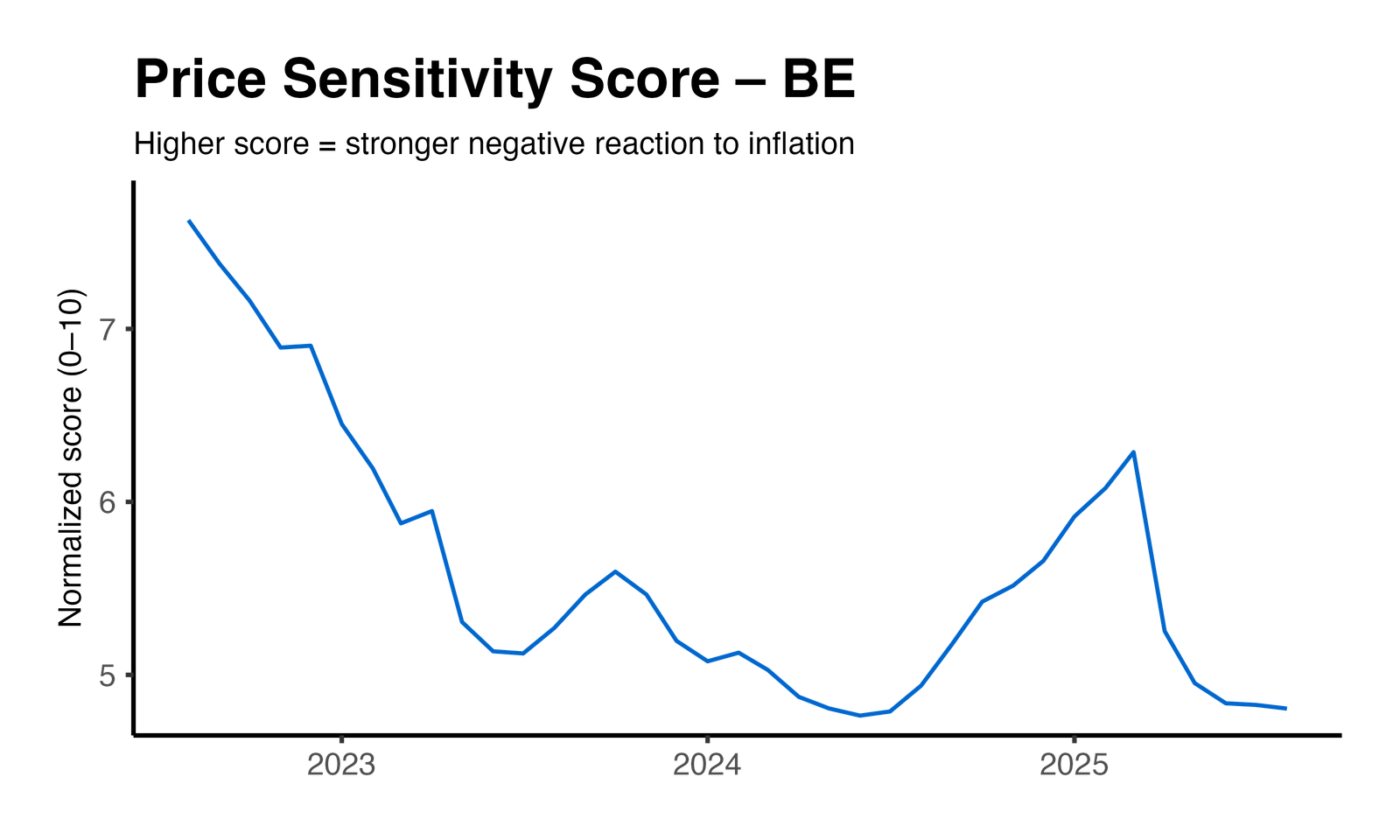

In the past year in Belgium, the normalized elasticity score saw a year-over-year change of -3%, indicating a slight decrease in market sensitivity. At the same time, the year-over-year volatility of this score increased by 78%, reflecting a significant rise in the variability of sensitivity. Despite these changes, the market remains highly sensitive compared to peers. These figures are based on a multilevel model incorporating macroeconomic controls, with a statistically significant price-effect p-value of less than 0.01. Businesses should consider maintaining flexible pricing strategies to accommodate the heightened volatility in market sensitivity.

Method: Price Elasticity Insights