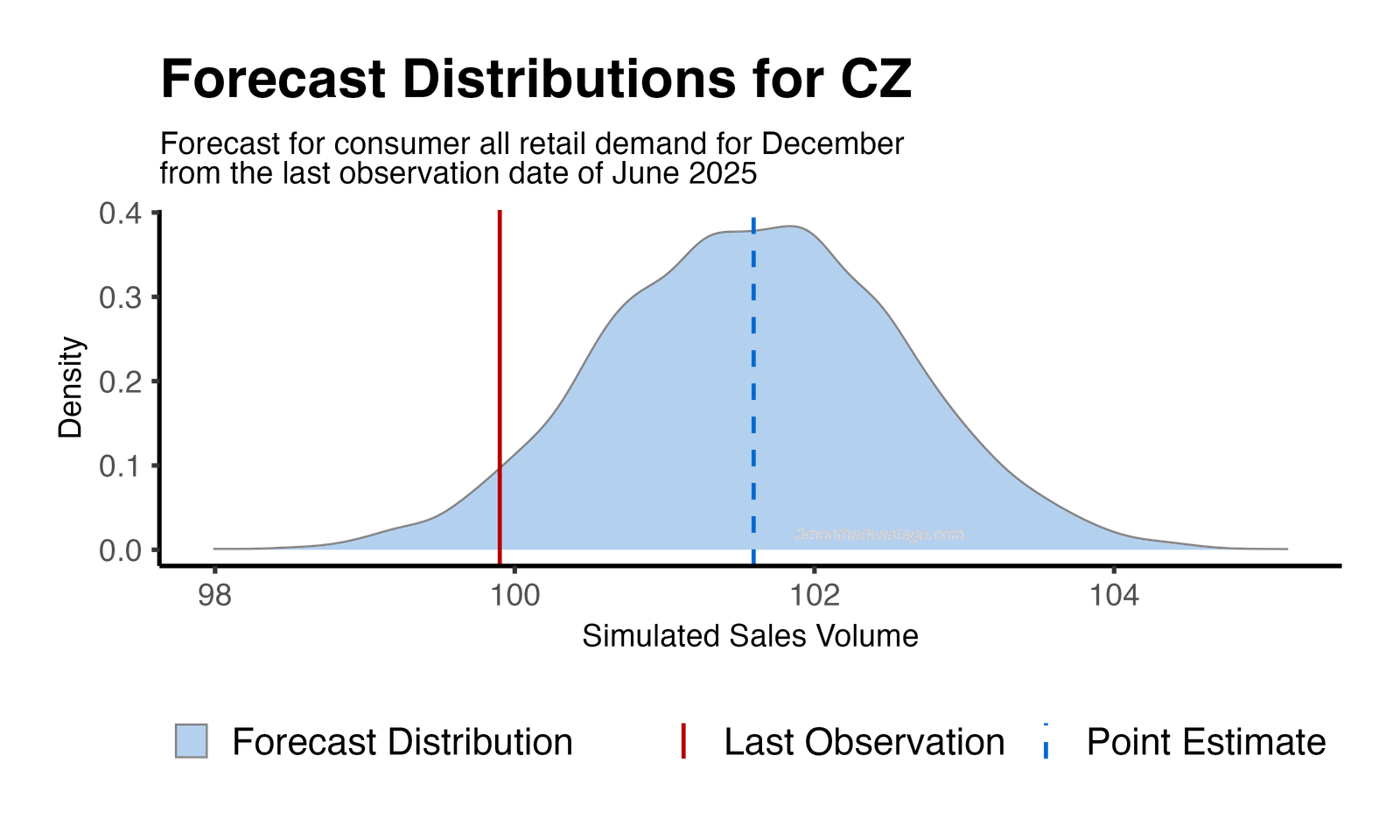

The retail sector in Czechia is expected to see no growth in August, with month-on-month momentum also at 0.0%. However, by December, sales are anticipated to rise by 1.7%. The sector's three-month forecast volatility is currently at 0, indicating a decrease of 0.45 from the previous year. These projections are based on the Eurostat consumer retail index data, reflecting a stable but modest outlook for the retail market in the near term.

Between June 2025 and December 2025, the forecast distribution indicates a 95% probability of an increase in overall retail sector demand. The central peak of the distribution curve represents the most likely demand outcomes, while the wider tails account for less probable variations.

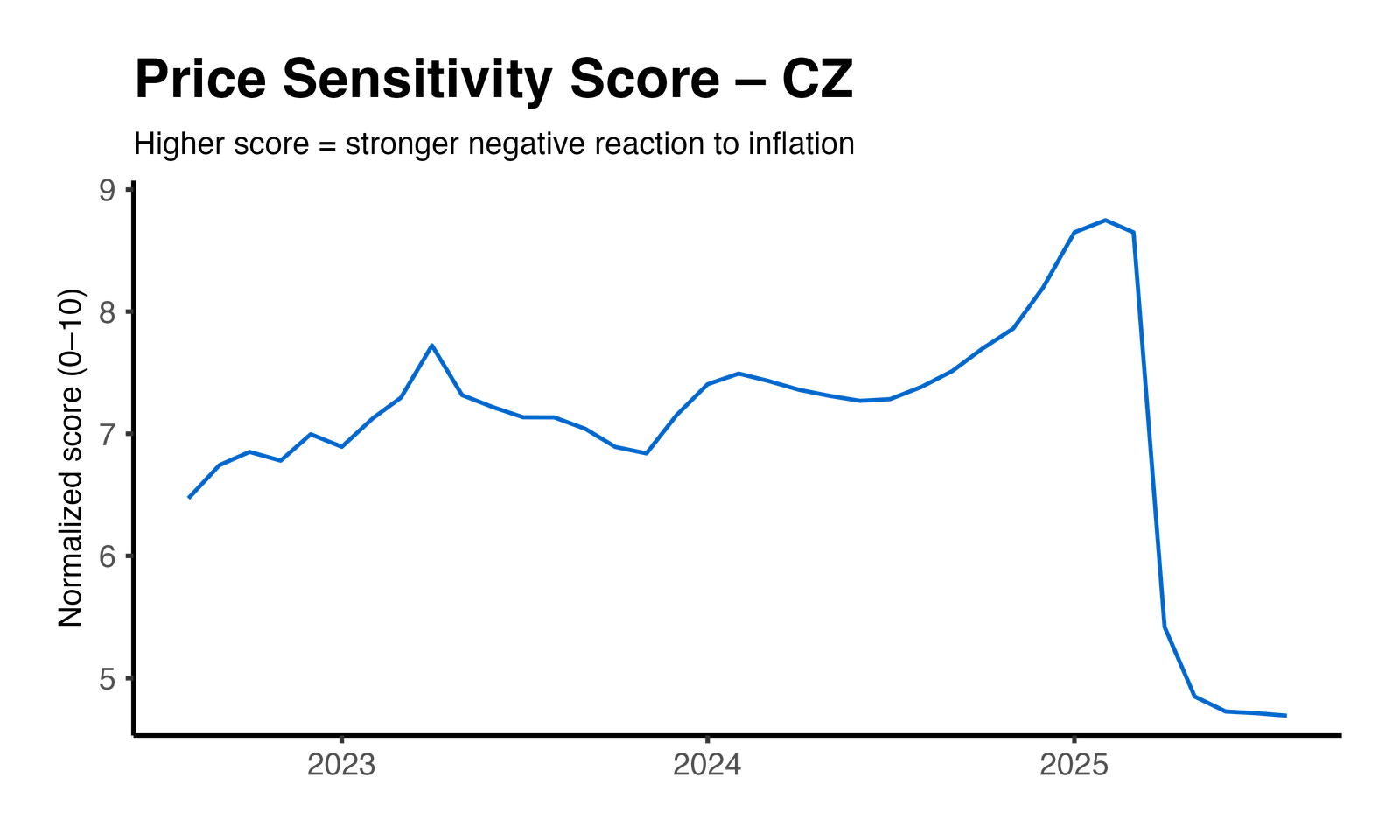

Czechia shows a slightly higher sensitivity to price changes compared to its European counterparts. The year-over-year normalized price-sensitivity score decreased by 36%, indicating a significant reduction, while the volatility of this score increased by 722%, reflecting a substantial rise in instability. These metrics, derived from rolling twelve-month windows, assess the drift and stability of price elasticity. The estimates are based on a hierarchical mixed-effects model that integrates data across various geographies, resulting in an overall price-effect *p*-value of less than 0.01. This suggests that pricing strategies in Czechia should be carefully managed to account for increased volatility in demand response.

Method: Price Elasticity Insights