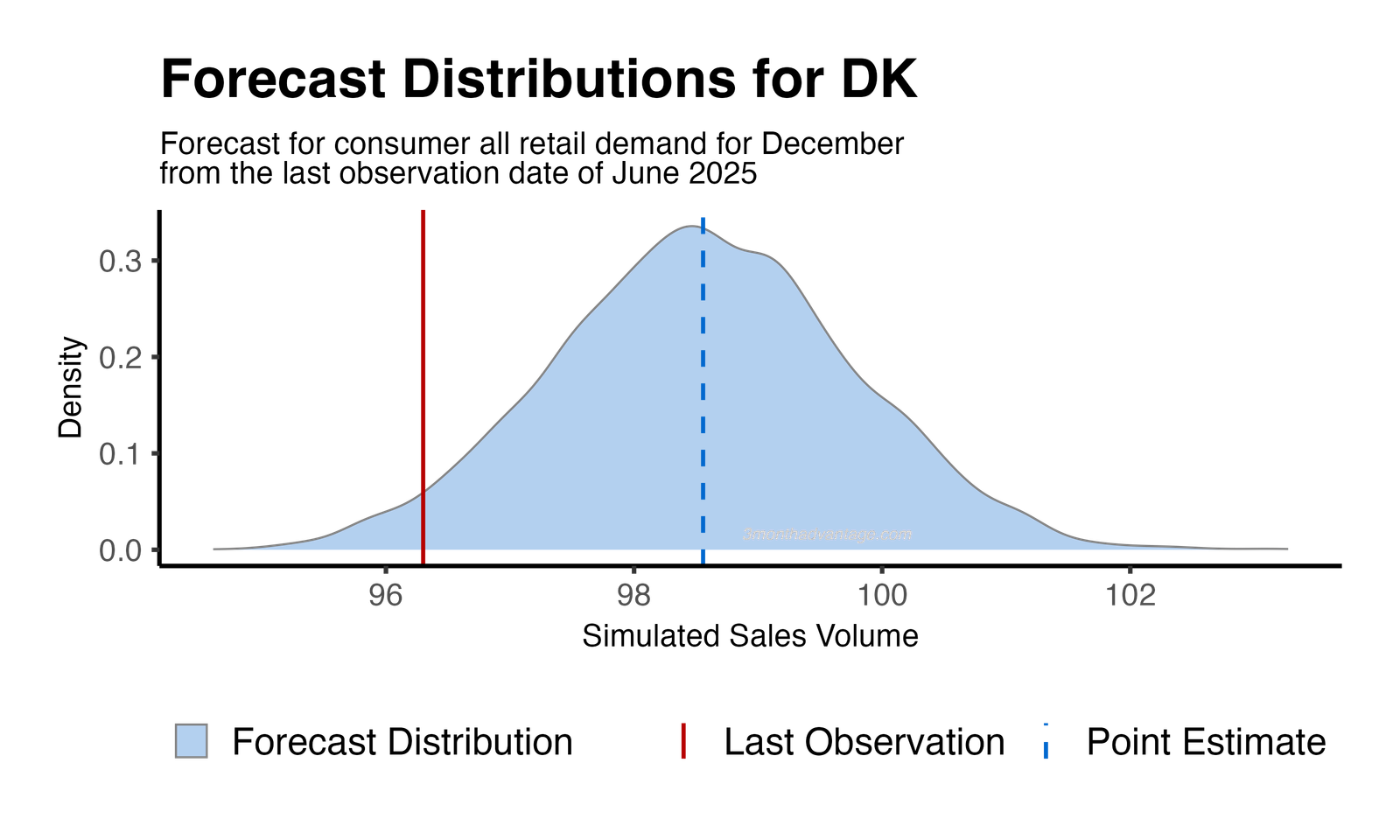

The retail sector in Denmark is expected to grow by 0.5% in August, with a month-on-month momentum of 0.8%. By December, sales are anticipated to rise by an additional 2.3%, indicating a positive trend in consumer spending. The sector's three-month forecast volatility is 0.4, reflecting an increase of 0.26 from the previous year, suggesting heightened uncertainty in market conditions. These projections are based on the Eurostat consumer retail index data, providing a data-driven outlook for the retail market.

Between June 2025 and December 2025, the forecast distribution indicates a 95% probability of an increase in overall retail sector demand. The central peak of the distribution curve represents the most likely demand outcomes, while the wider tails account for less probable variations.

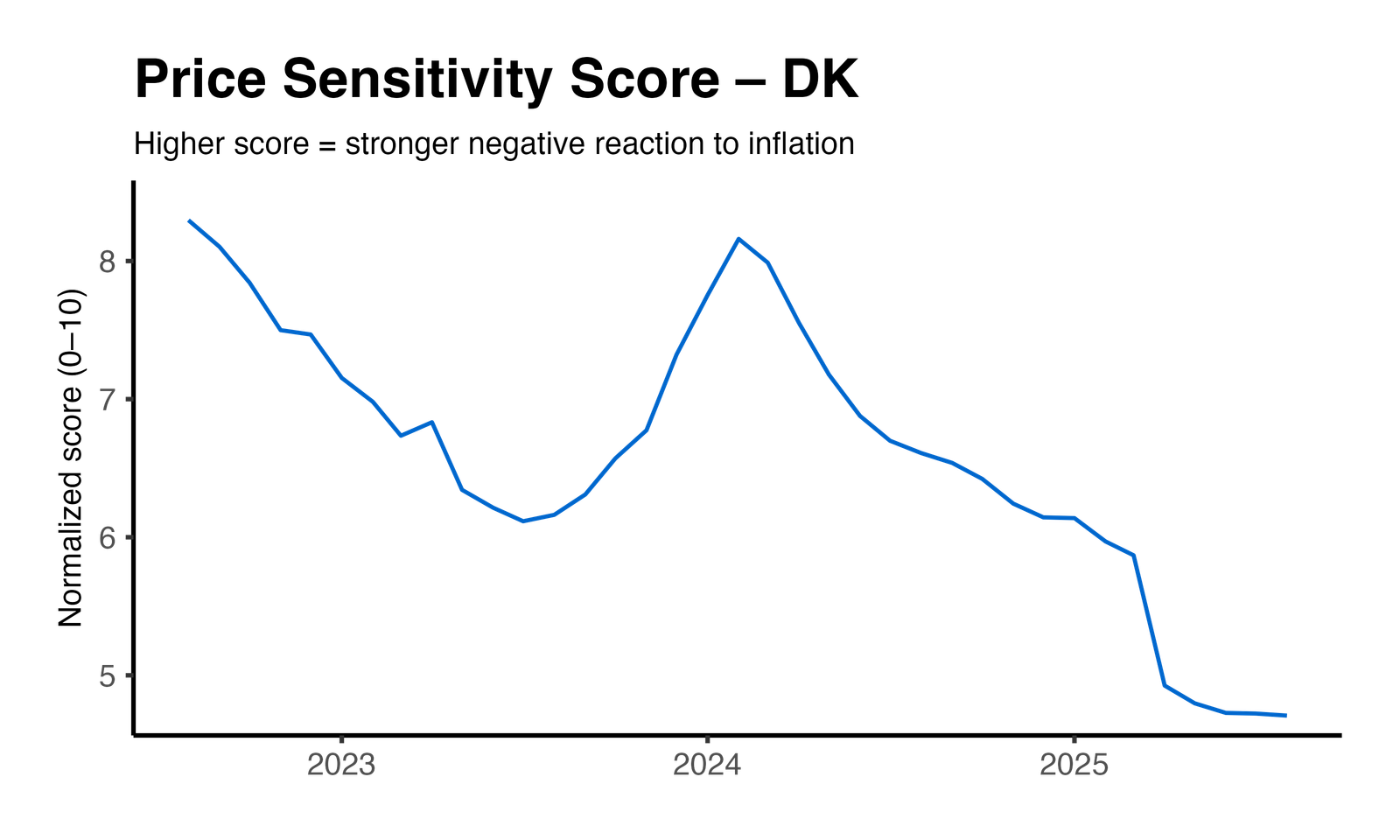

Over the past year in Denmark, the normalized elasticity score experienced a year-over-year decrease of 29%, indicating a significant reduction in market sensitivity to price changes. Concurrently, the year-over-year volatility of this score increased by 24%, suggesting a slight decrease in the stability of this sensitivity. These figures are based on a multilevel model incorporating macroeconomic controls, with a statistically significant price-effect p-value of less than 0.01. The current market conditions, characterized by reduced sensitivity and slightly decreased volatility, imply that businesses may need to adjust their pricing and promotional strategies to account for the diminished responsiveness of consumers to price changes.

Method: Price Elasticity Insights