Retail sales are expected to increase by 0.6% in August, with a predicted month-on-month growth of 0.6% for this category. The total change by December is anticipated to be 1.9%. Volatility over the three-month forecast period is 0.4, indicating a year-on-year change of -0.39. These figures specifically pertain to the sector as reported by Eurostat.

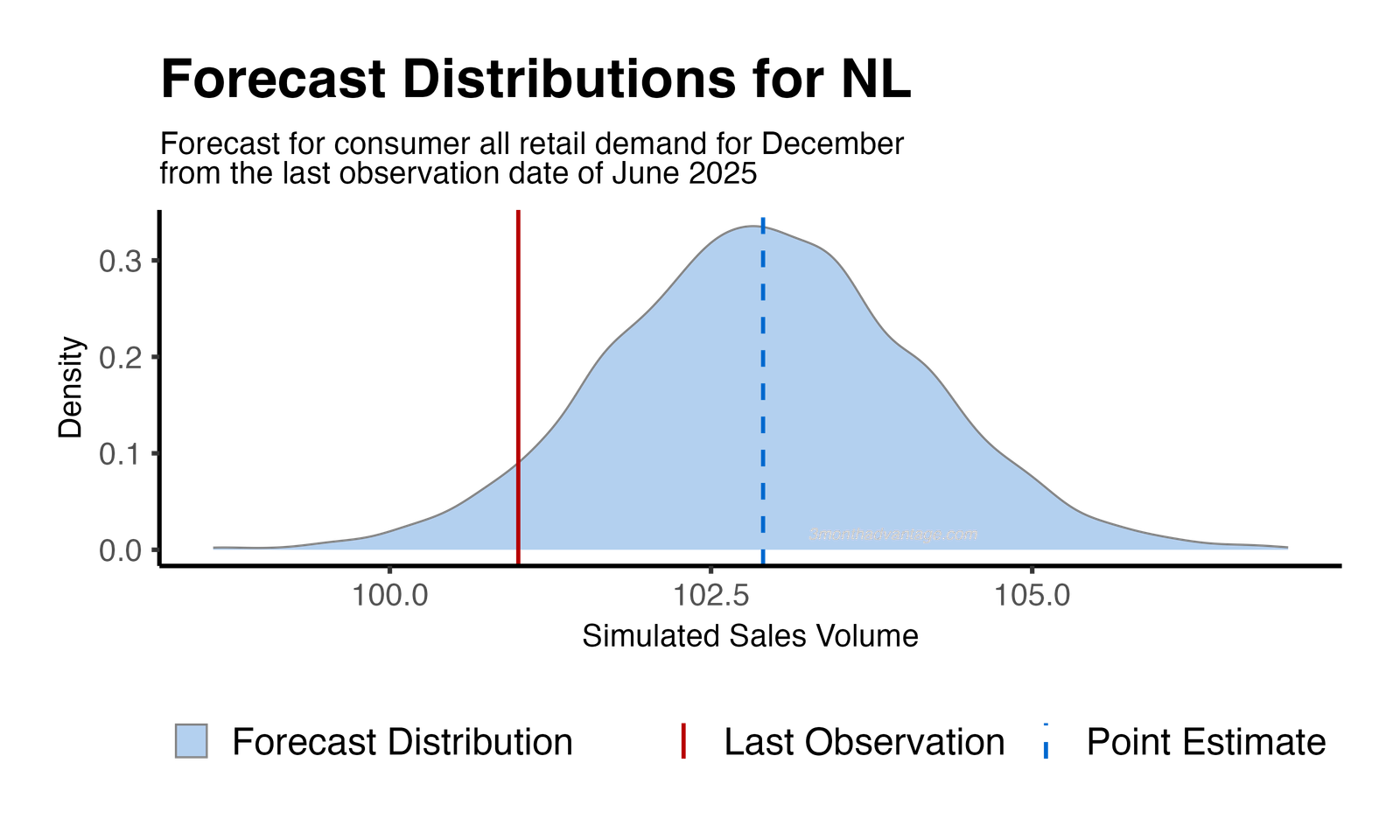

The forecast for the retail sector from June 2025 to December 2025 indicates a 94% probability of increased demand. The distribution curve illustrates forecast uncertainty, with the peak representing the most likely demand outcomes and the tails indicating less probable scenarios.

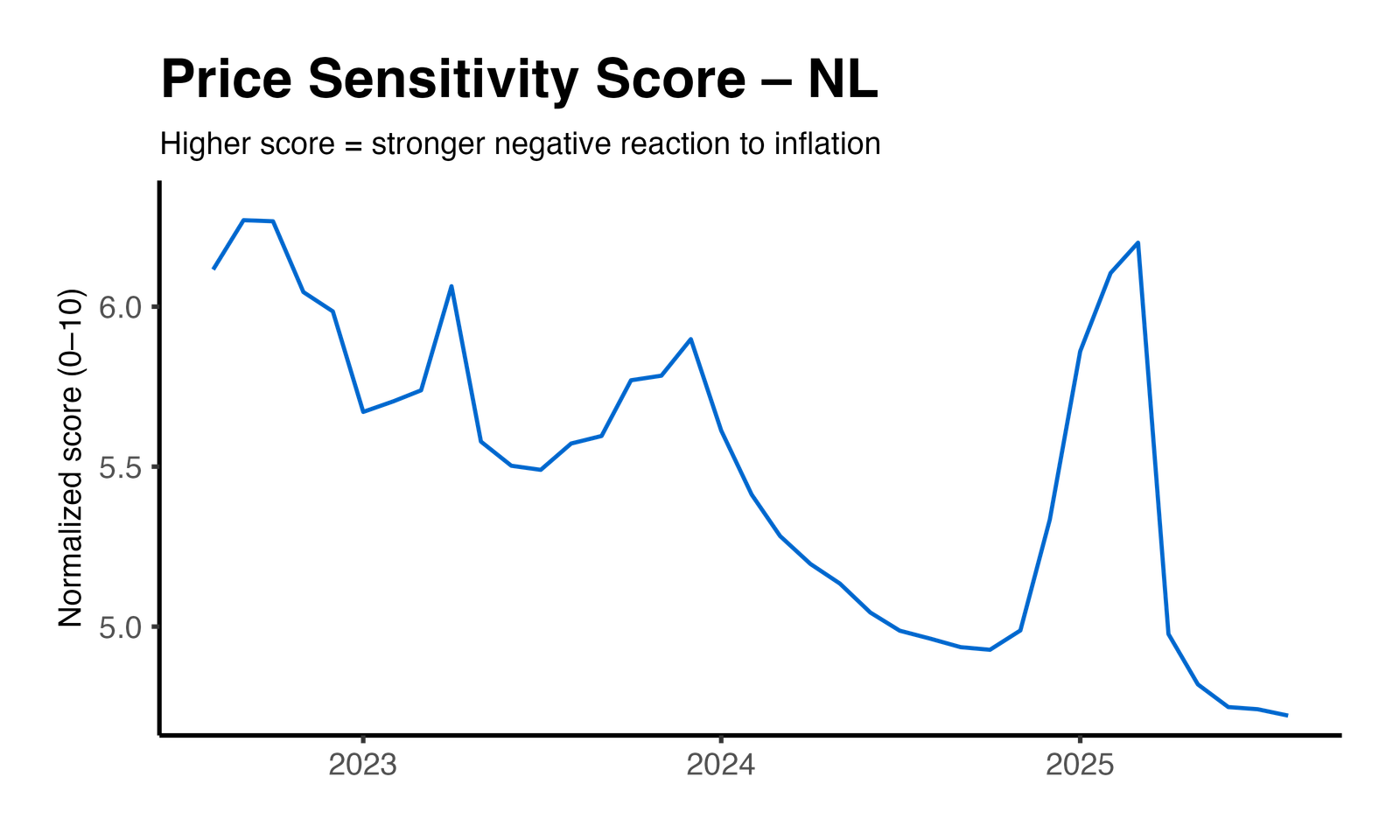

The Netherlands shows a slightly higher sensitivity to price changes compared to its European counterparts. Over the past year, the normalized price-sensitivity score decreased by 5%, while the volatility of this score decreased by 64%, indicating a slight reduction in both price elasticity and its variability. These metrics are derived from a hierarchical mixed-effects model that aggregates data across different regions, resulting in a statistically significant overall price-effect *p*-value of less than 0.01. This suggests that pricing strategies in the Netherlands should be carefully managed to maintain demand stability.

Method: Price Elasticity Insights