The retail sector in Spain is expected to see a modest growth of 0.3% in August. However, the month-on-month momentum shows a slight decline of 0.1% for the current period. Looking ahead to December, sales are anticipated to rise by 2.1%, suggesting a stronger performance towards the end of the year. The three-month forecast volatility in the sector is 0.2, which is a decrease of 0.53 from the previous year, indicating reduced fluctuations in retail performance. These projections are based on the Eurostat consumer retail index data.

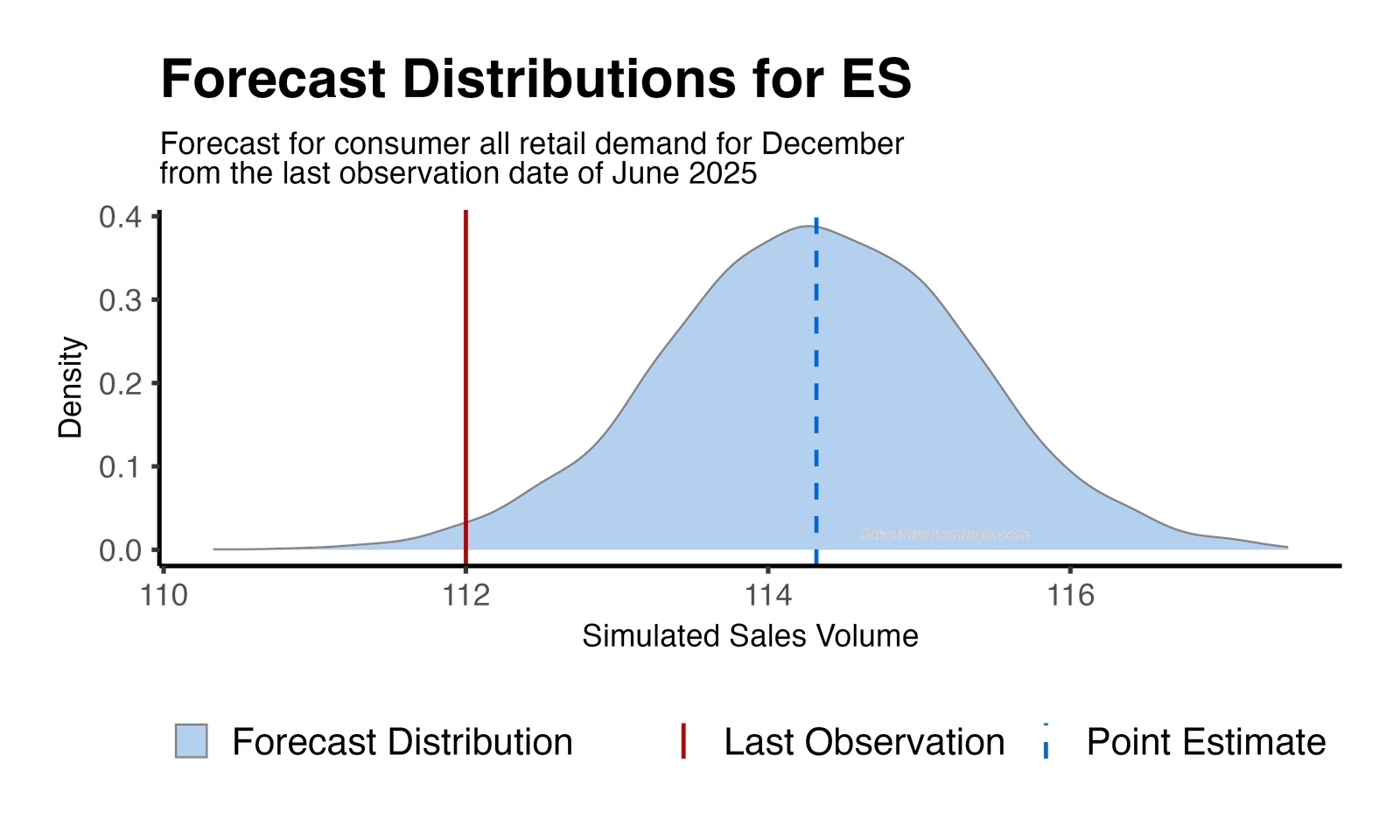

The forecast distribution for the period between June 2025 and December 2025 indicates a 95% probability of an increase in overall retail sector demand. The central peak of the distribution curve represents the most likely demand outcomes, while the wider tails account for less probable variations.

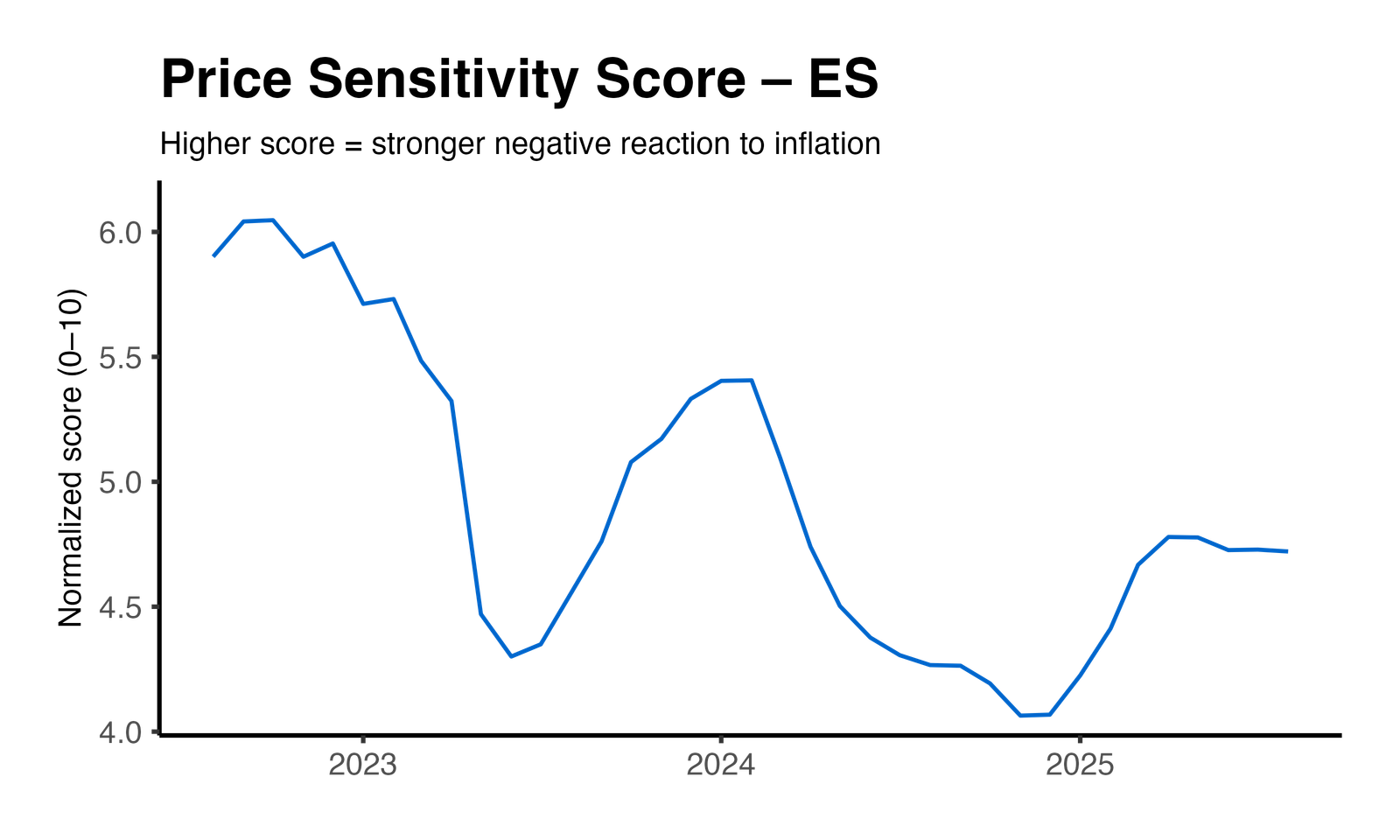

During the past year in Spain, the normalized elasticity score saw an 11% year-over-year change, indicating a slight rise in market sensitivity. At the same time, the year-over-year volatility of this score dropped by 33%, suggesting a decrease in market fluctuations. These figures are derived from a multilevel model with macroeconomic controls, showing a statistically significant price-effect p-value of less than 0.01. The business implication of these results is that companies should consider leveraging the increased sensitivity and reduced volatility in their pricing and promotional strategies to optimize market responsiveness.

Method: Price Elasticity Insights