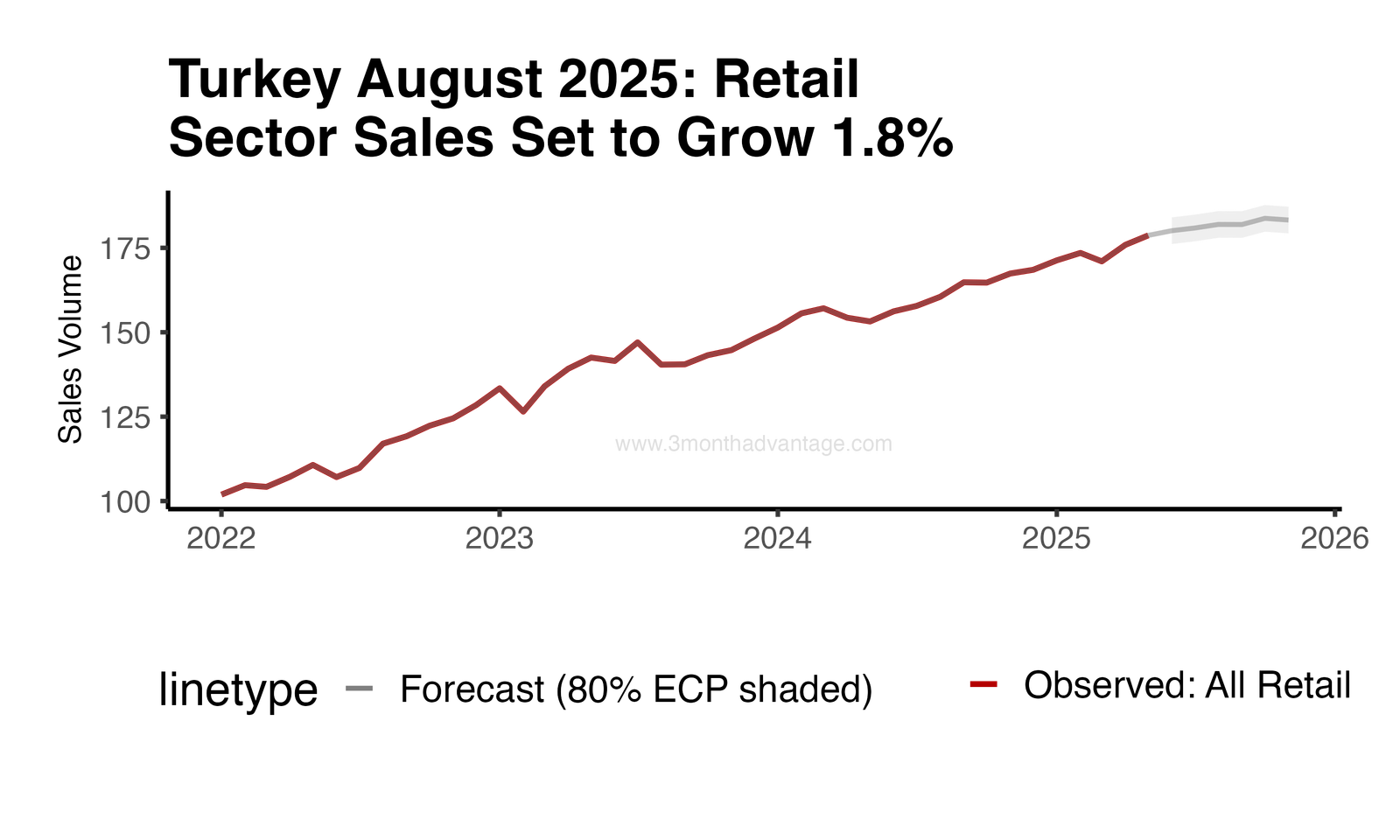

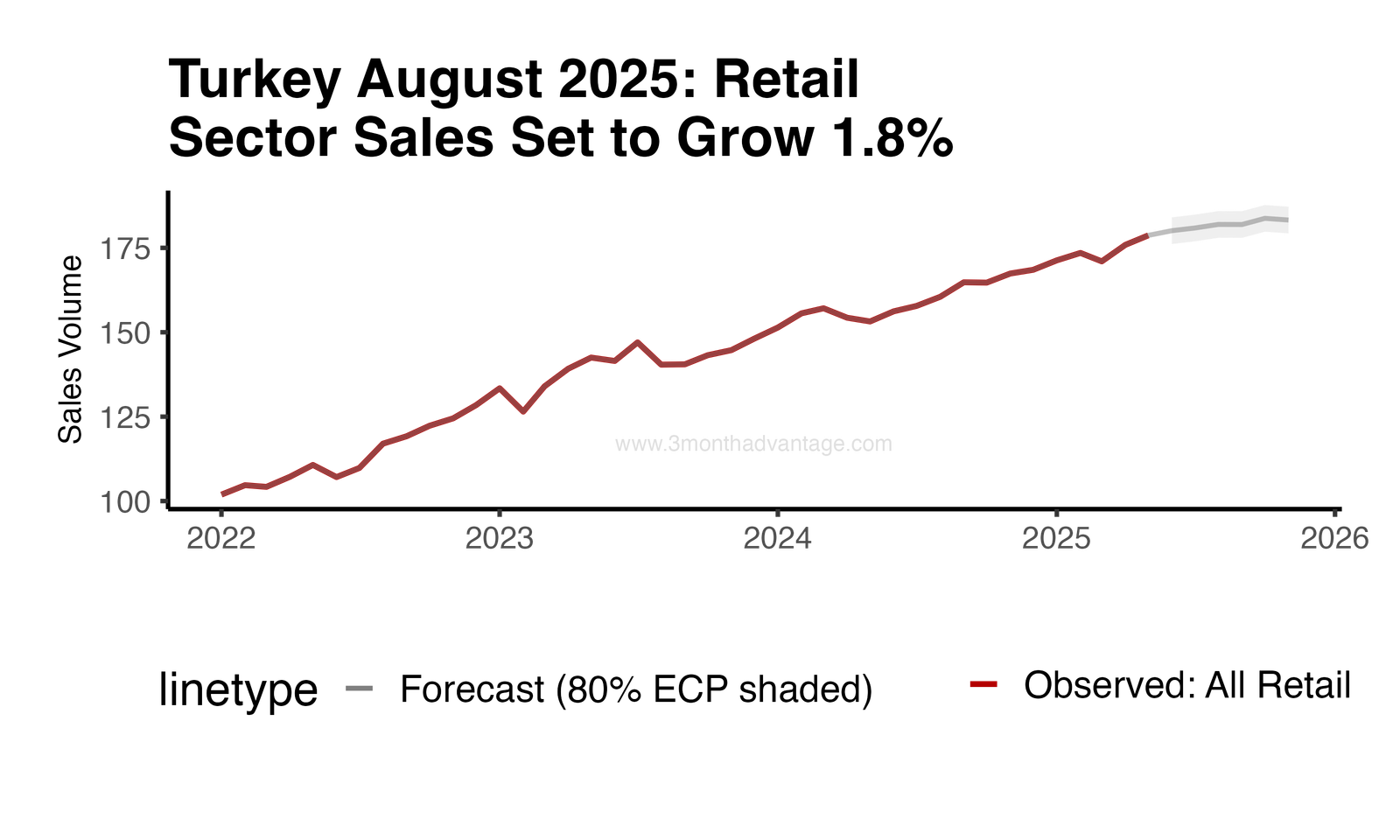

Retail sales are projected to grow by 1.8% in August. The forecasted month-on-month momentum for this category is 0.6%. The cumulative change by November is expected to reach 2.5%. Volatility across the three-month forecast horizon was 0.9, reflecting a year-on-year change of -1.24. The data refer specifically to the sector as reported by Eurostat.

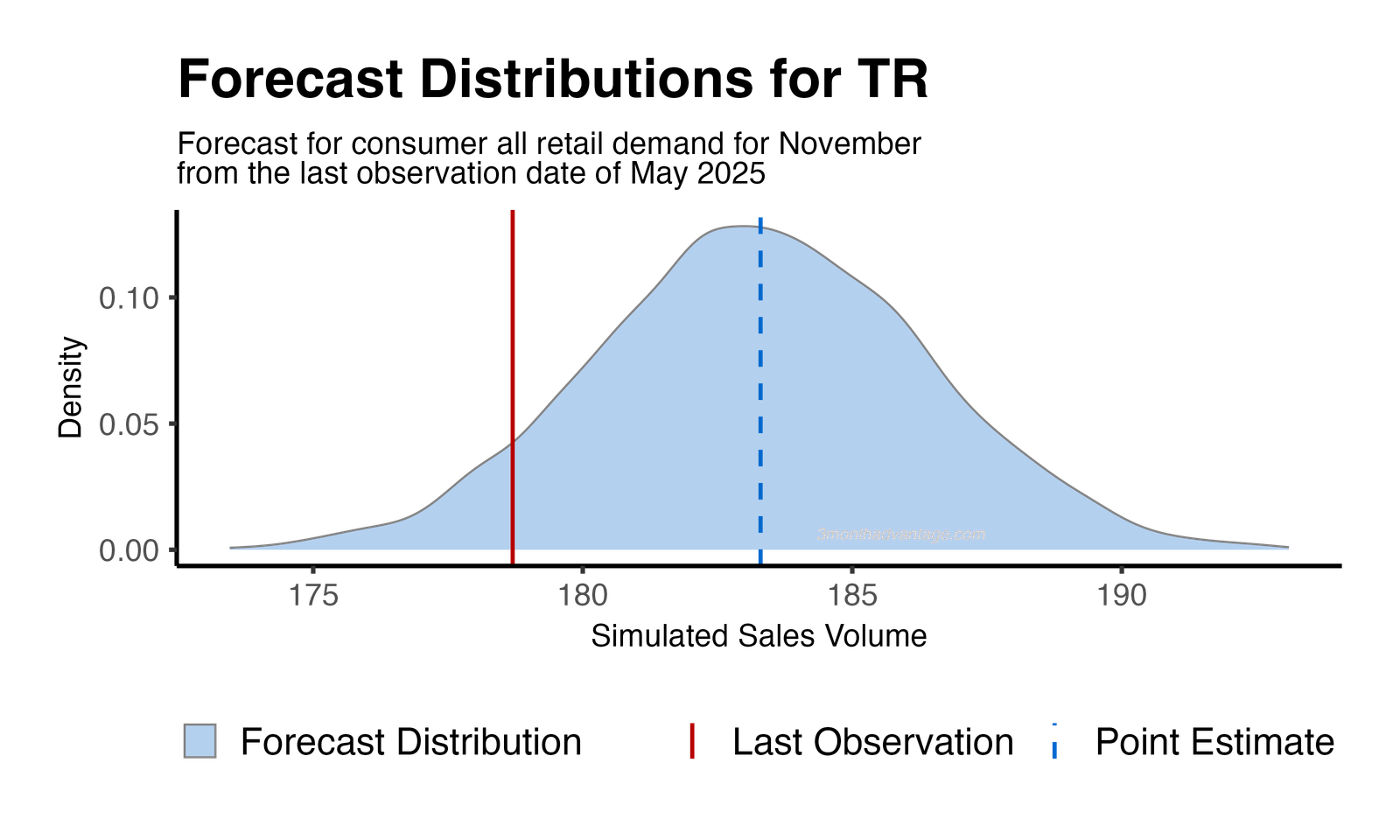

The forecast for the retail sector from May 2025 to November 2025 indicates a 93% probability of increased demand. The distribution curve illustrates forecast uncertainty, with the peak representing the most likely demand values and the tails indicating less probable outcomes. This suggests a strong confidence in demand growth, with some variability in the extent of the increase.

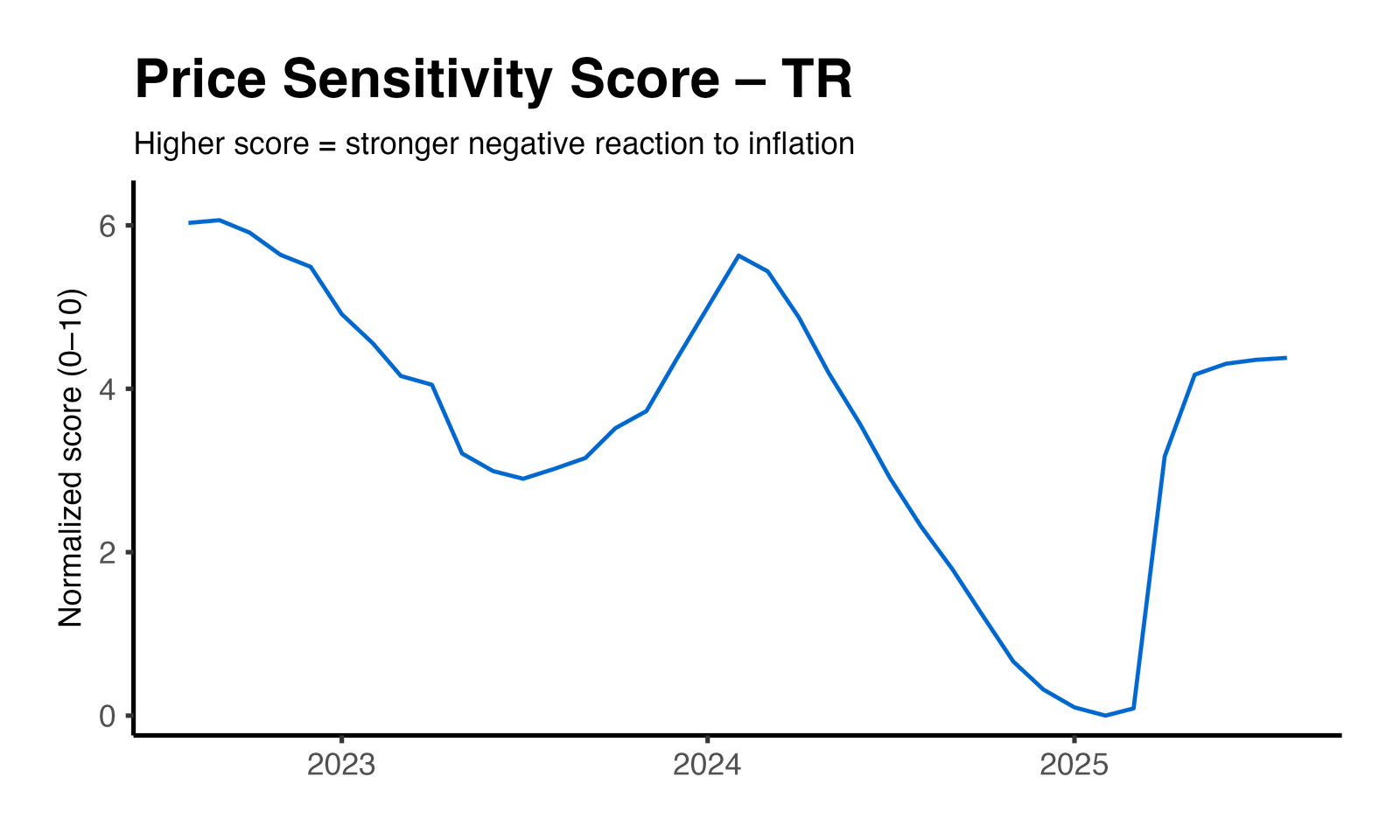

Over the past year in Türkiye, the normalized elasticity score exhibited a year-over-year increase of 89%, while the year-over-year volatility of this score decreased by 82%. These figures indicate a significant rise in market sensitivity and a marginal reduction in volatility, suggesting that the market is currently less responsive to price changes compared to its peers. The data is sourced from a multilevel model incorporating macroeconomic controls, with a statistically significant price-effect p-value of less than 0.01. For businesses, this implies a need for more strategic pricing and promotional planning to effectively engage a market that is less sensitive to price fluctuations.

Method: Price Elasticity Insights