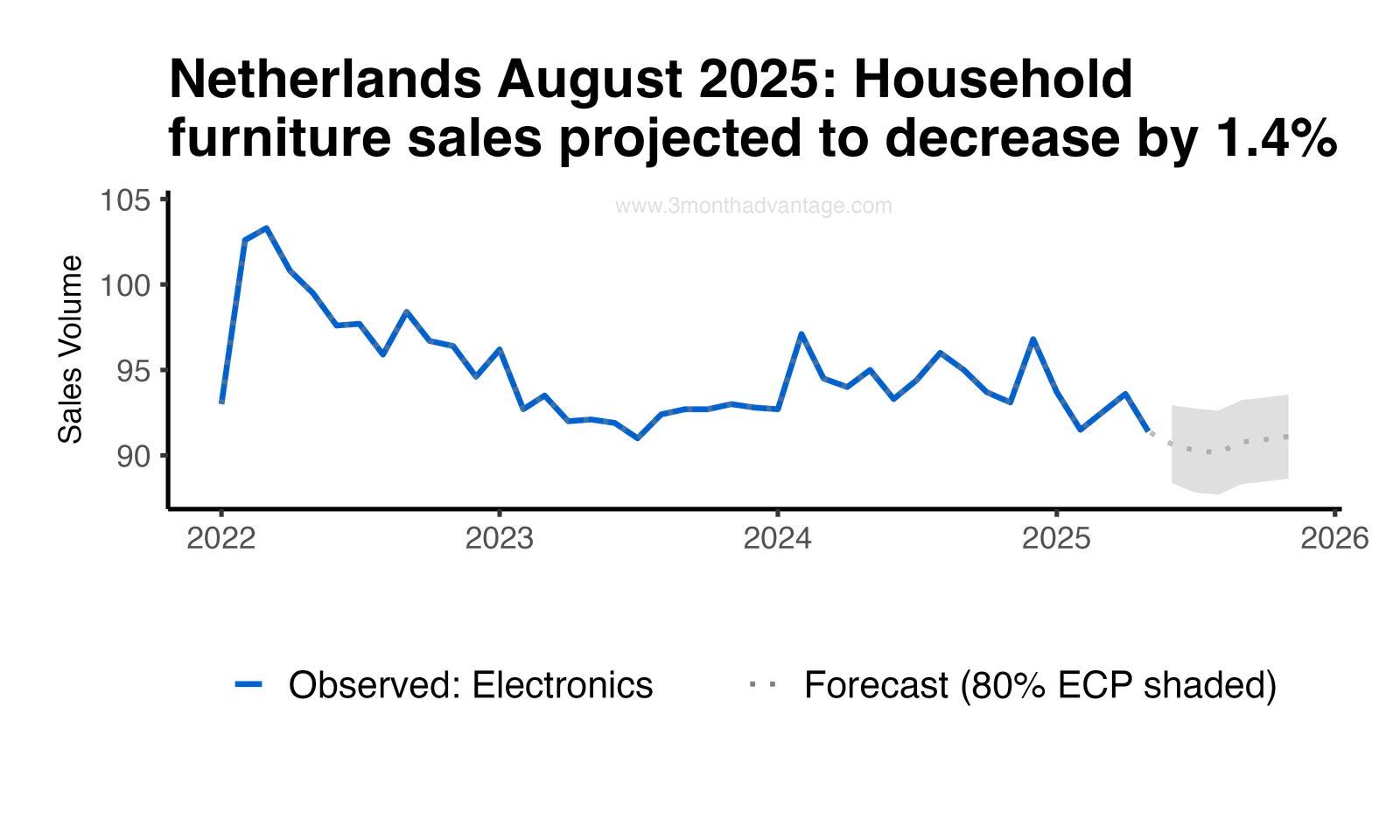

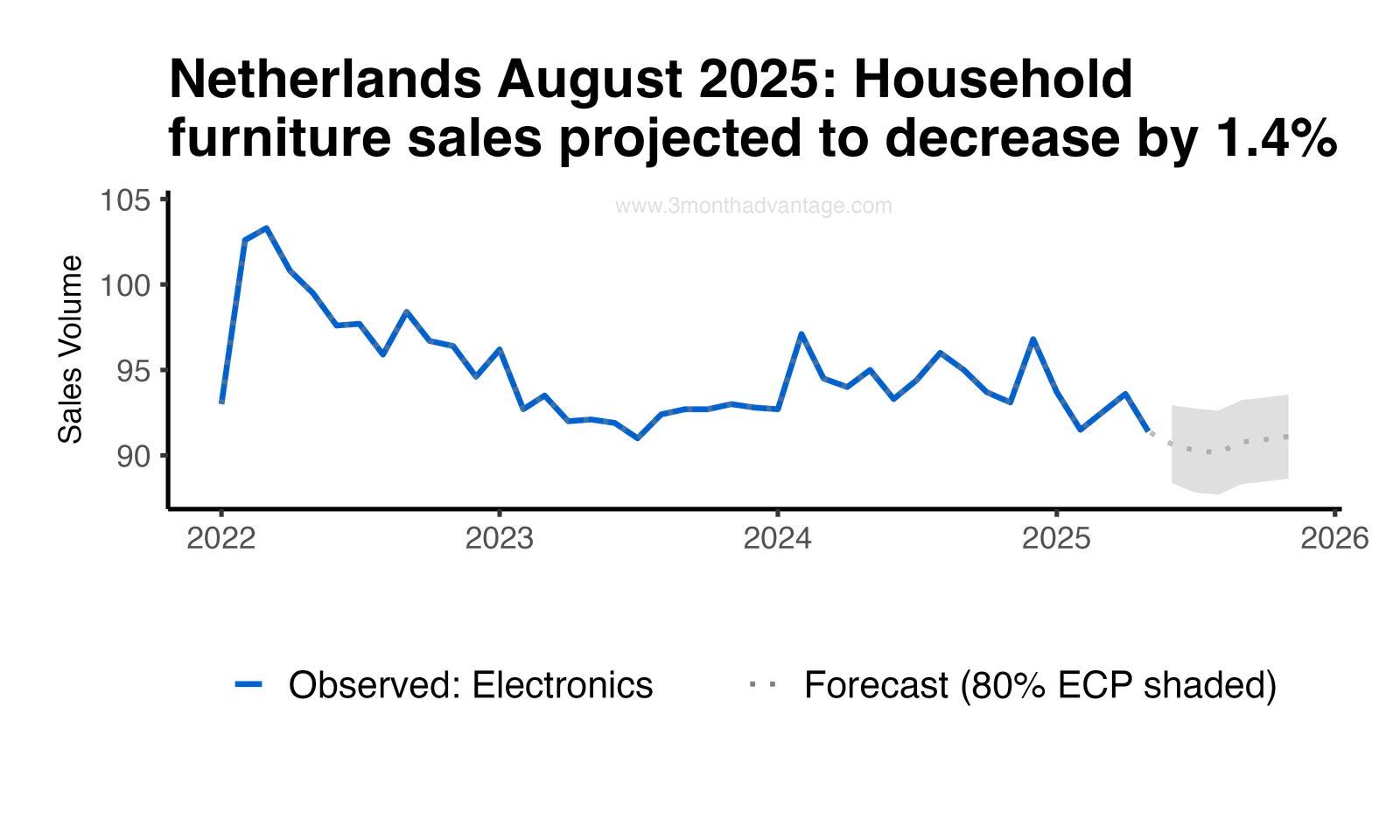

In August, household furniture and equipment retail sales are projected to decrease by 1.4%. The expected month-on-month momentum for this category is -0.1%. By November, the cumulative change is anticipated to reach 0.3%. The volatility over the three-month forecast horizon is 0.3, indicating a year-on-year change of -1.1%. These figures relate specifically to the household furniture and equipment retail segment as reported by Eurostat.

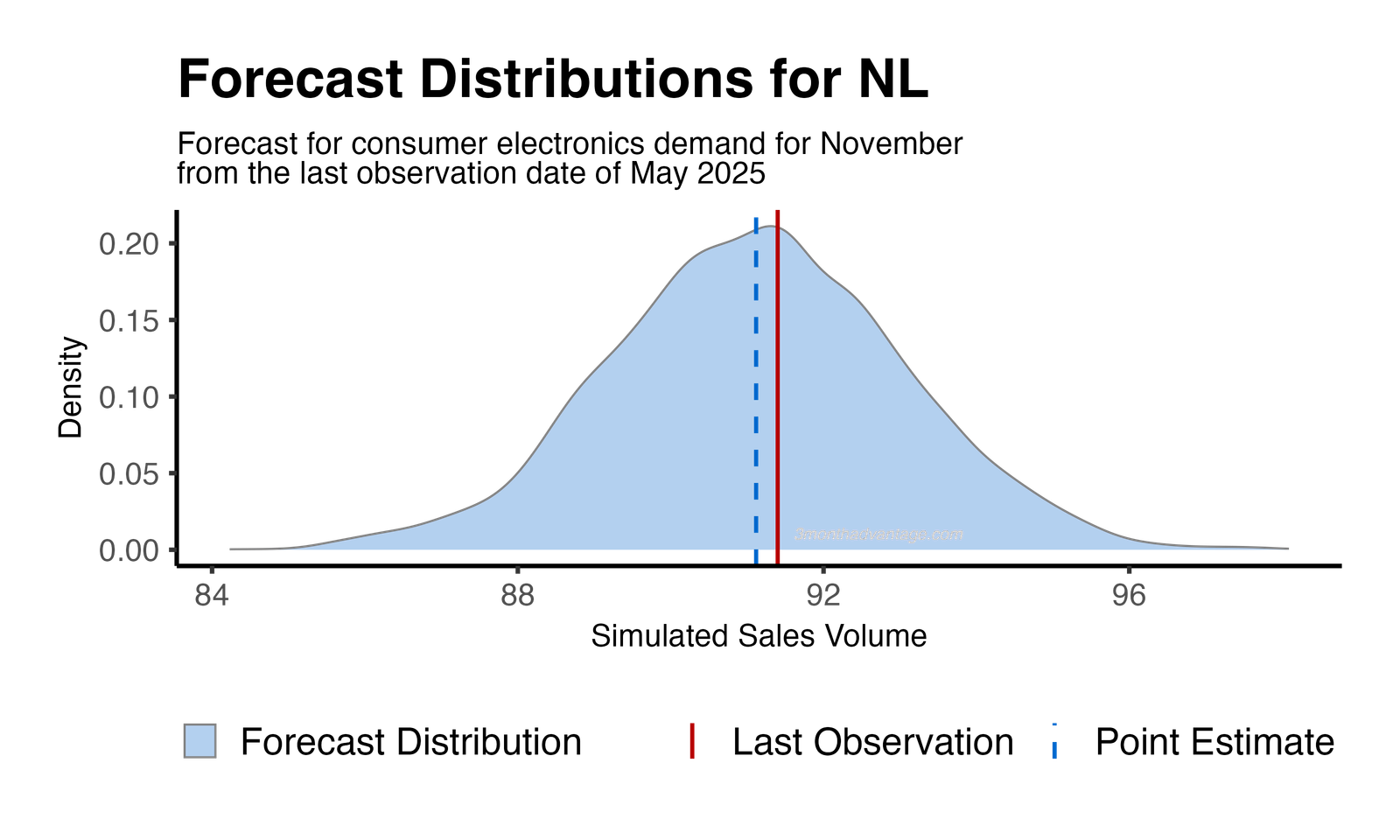

Between May 2025 and November 2025, there is a 55% probability that demand for household furniture and equipment retail will decline. The forecast distribution's central peak indicates the most likely outcomes, with wider tails representing less probable demand variations. This probability suggests that businesses should consider adjusting pricing, inventory, and promotional strategies to mitigate potential impacts of decreased demand.

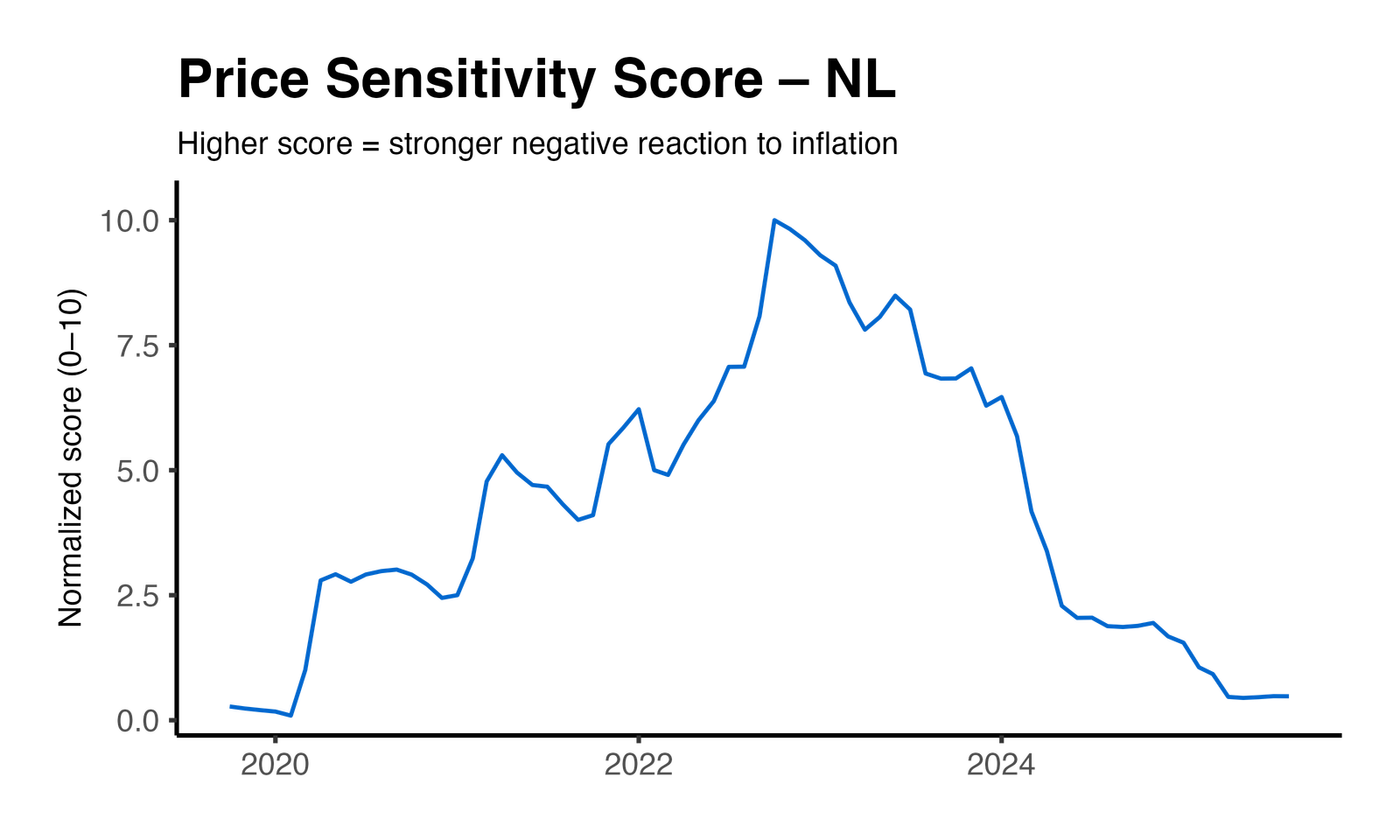

Over the past year in the Netherlands, the normalized elasticity score experienced a year-over-year change of -75%, while the year-over-year volatility of that score decreased by 70%. This indicates a slight increase in both market sensitivity and volatility, suggesting that the market is currently more sensitive compared to its peers. These figures are based on a multilevel model incorporating macroeconomic controls, with a statistically significant price-effect p-value of less than 0.01. The business implication of these results is that companies should exercise caution in pricing and promotional planning, as the market's increased sensitivity may lead to more pronounced consumer reactions to price changes.

Method: Price Elasticity Insights