In August, household furniture and equipment retail sales are expected to increase by 1.2%. The projected month-on-month momentum for this category is 0.2%, indicating a steady rise. By December, the cumulative change is anticipated to reach 1.8%. The volatility over the three-month forecast period is measured at 0.5, reflecting a year-on-year change of 0.14. These figures specifically relate to the household furniture and equipment retail segment as reported by Eurostat.

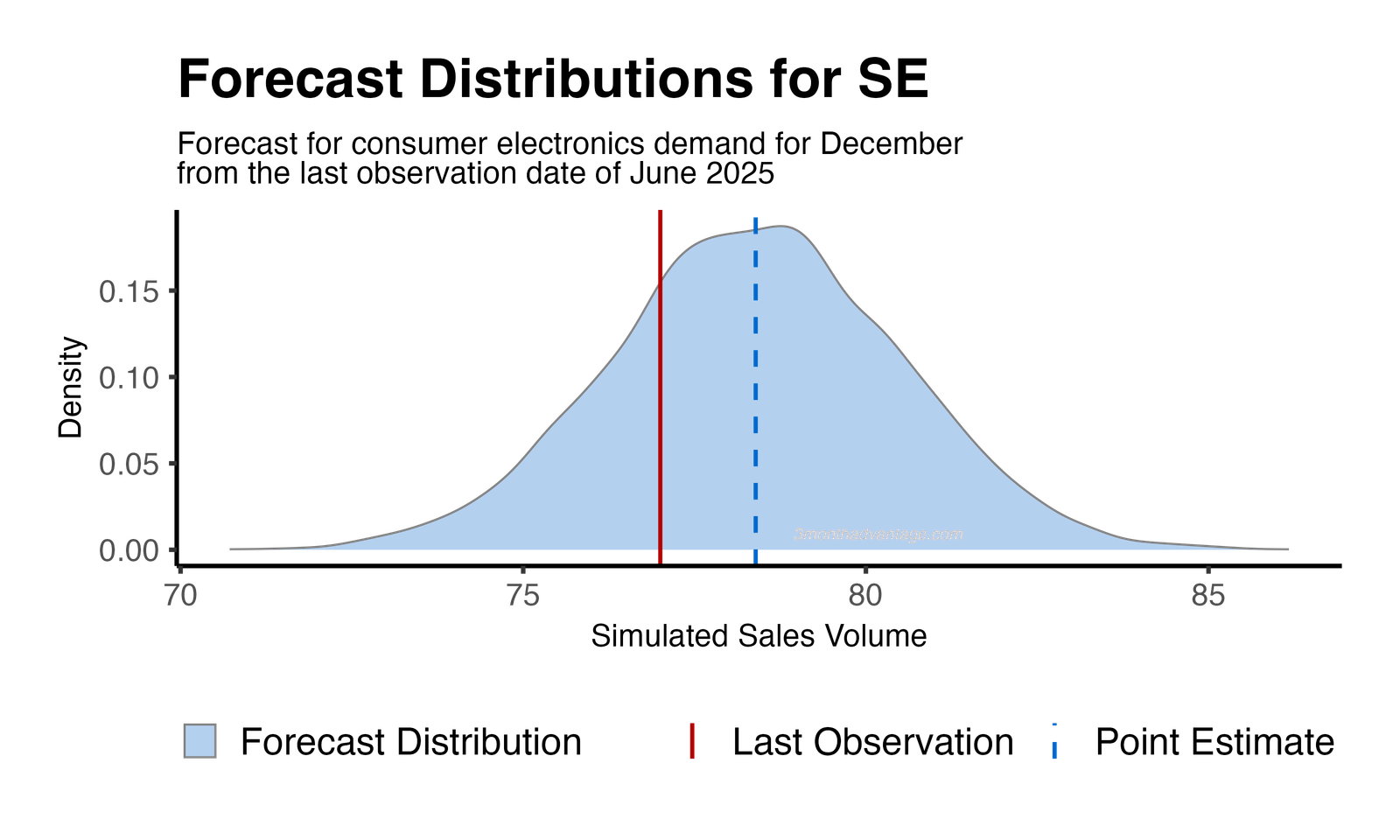

The forecast for the household furniture and equipment retail sector indicates a 75% probability of increased demand by December 2025. The distribution curve highlights the most likely demand outcomes at its peak, with the tails representing less probable scenarios. Businesses should leverage this forecast to optimize inventory levels and adjust marketing strategies, while also preparing contingency plans for less likely demand fluctuations.

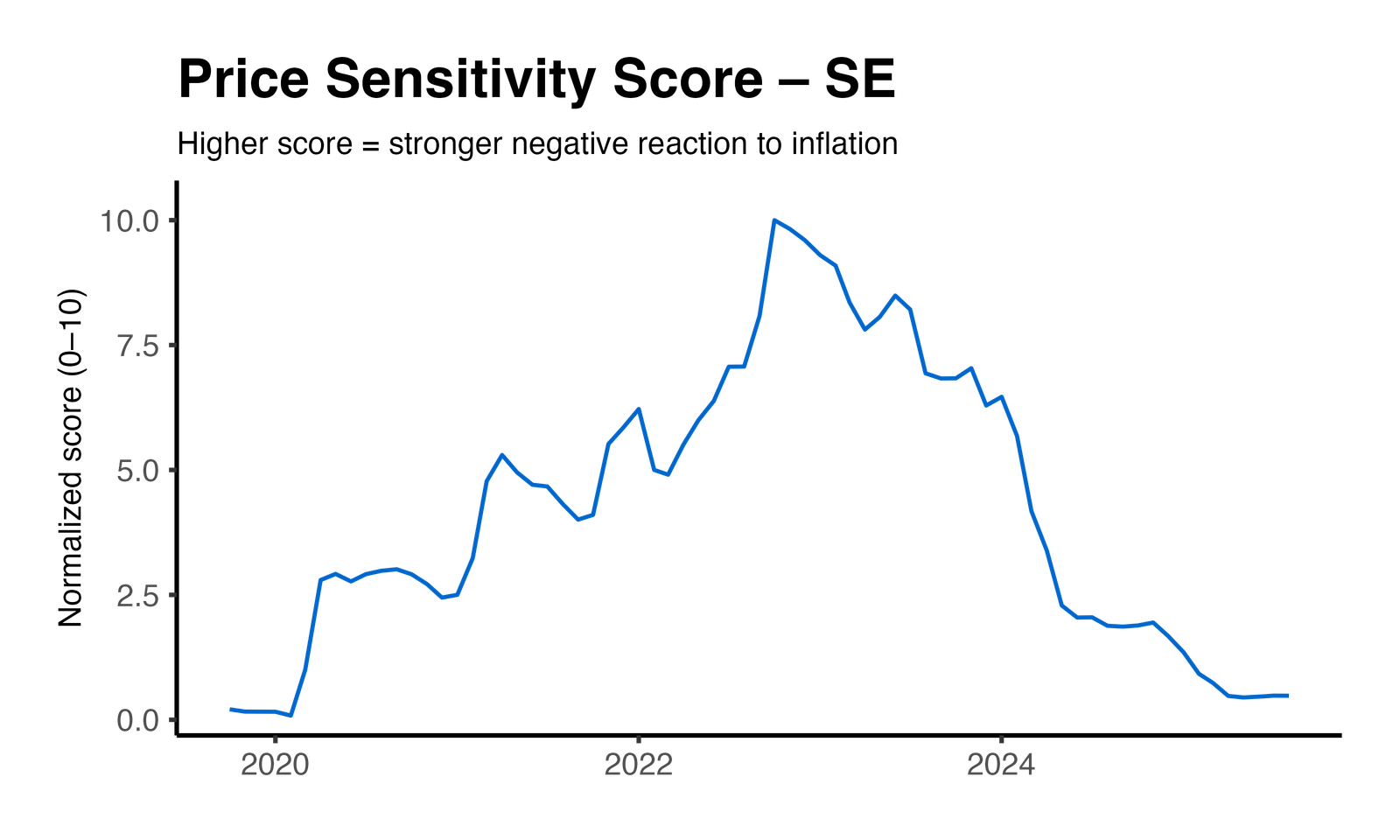

Sweden shows a slightly higher sensitivity to price changes compared to its European counterparts, as indicated by a year-over-year (YoY) change in the normalized price-sensitivity score of -74%, reflecting a slight increase in sensitivity. At the same time, the YoY volatility of this score decreased by 70%, indicating enhanced stability. These metrics, derived from rolling twelve-month windows, evaluate the drift and stability of price elasticity within the household furniture and equipment retail sector. The estimates are based on a hierarchical mixed-effects model that integrates data across various geographies, resulting in an overall price-effect *p*-value of less than 0.01. This suggests that pricing strategies in Sweden should be carefully calibrated to maintain demand stability.

Method: Price Elasticity Insights