Retail sales are expected to decrease by 0.7% in August. The predicted month-on-month momentum for this category is -0.3%. The cumulative change by December is anticipated to be 1.7%. Volatility over the three-month forecast period was 0.4, indicating a year-on-year change of -1.33%. These figures pertain specifically to the sector as reported by Eurostat.

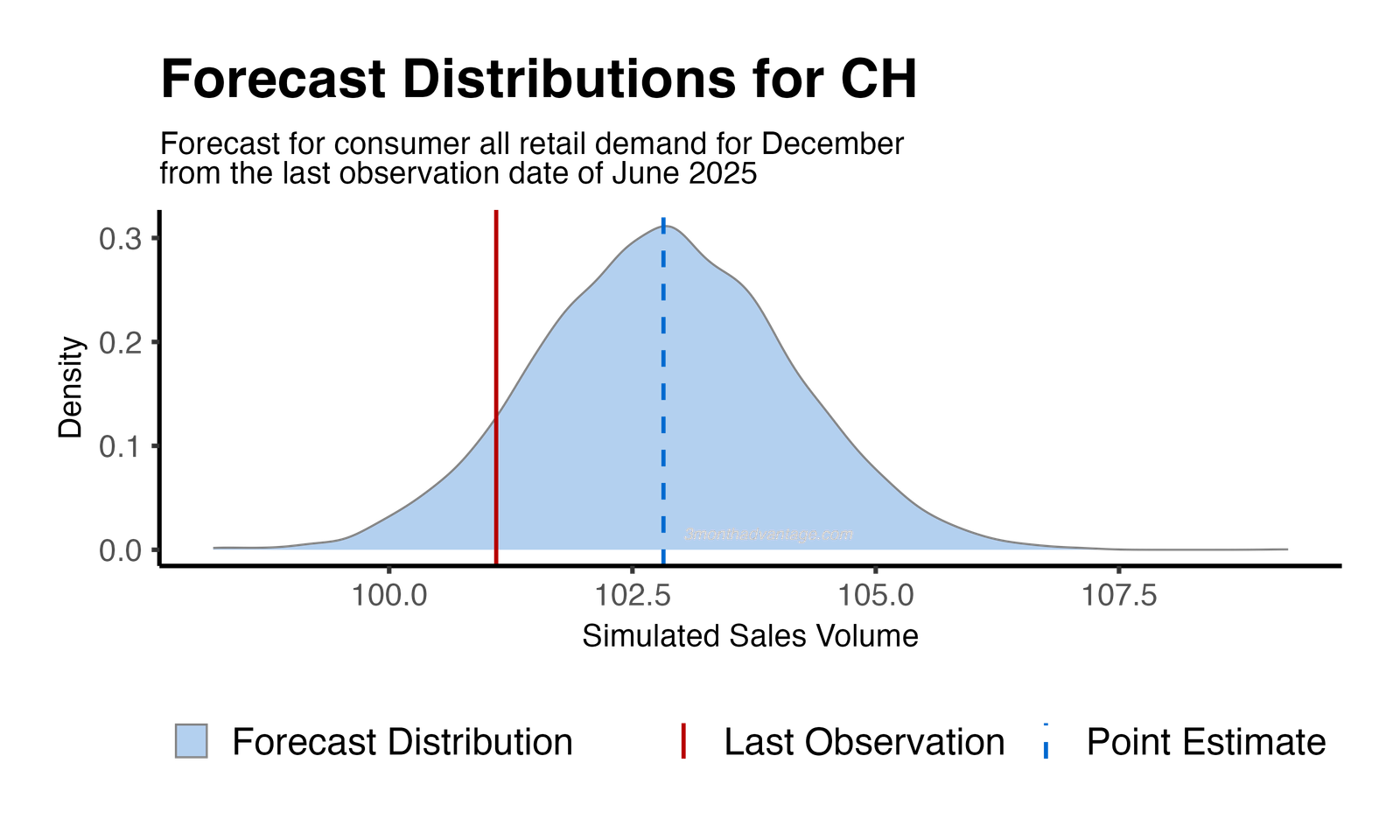

The forecast for the retail sector from June 2025 to December 2025 indicates a 91% probability of increased demand. The distribution curve illustrates forecast uncertainty, with the peak representing the most likely demand levels and the tails indicating less probable outcomes. This suggests a strong confidence in growth, with some variability in the extent of the increase.

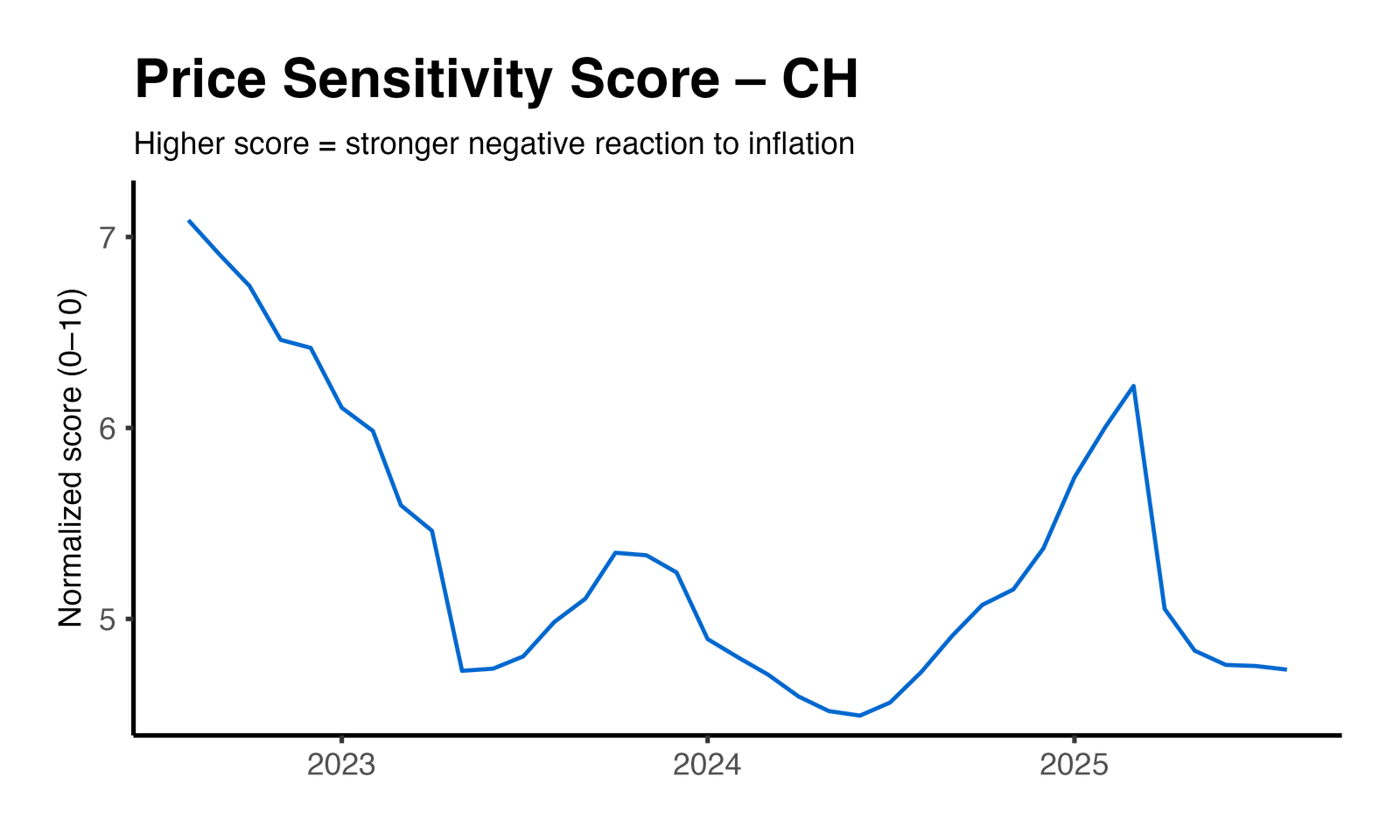

Switzerland shows a slightly sensitive response to price changes compared to its European counterparts. The year-over-year normalized price-sensitivity score remained unchanged, indicating a slight decrease, while the volatility of this score decreased by 60%, suggesting enhanced stability. These metrics, derived from rolling twelve-month windows, reflect the year-over-year drift and stability of price elasticity. The estimates are based on a hierarchical mixed-effects model that aggregates data across various geographies, resulting in an overall price-effect *p*-value of less than 0.01. This suggests that pricing strategies in Switzerland should consider the relatively stable yet sensitive nature of demand in response to price changes.

Method: Price Elasticity Insights